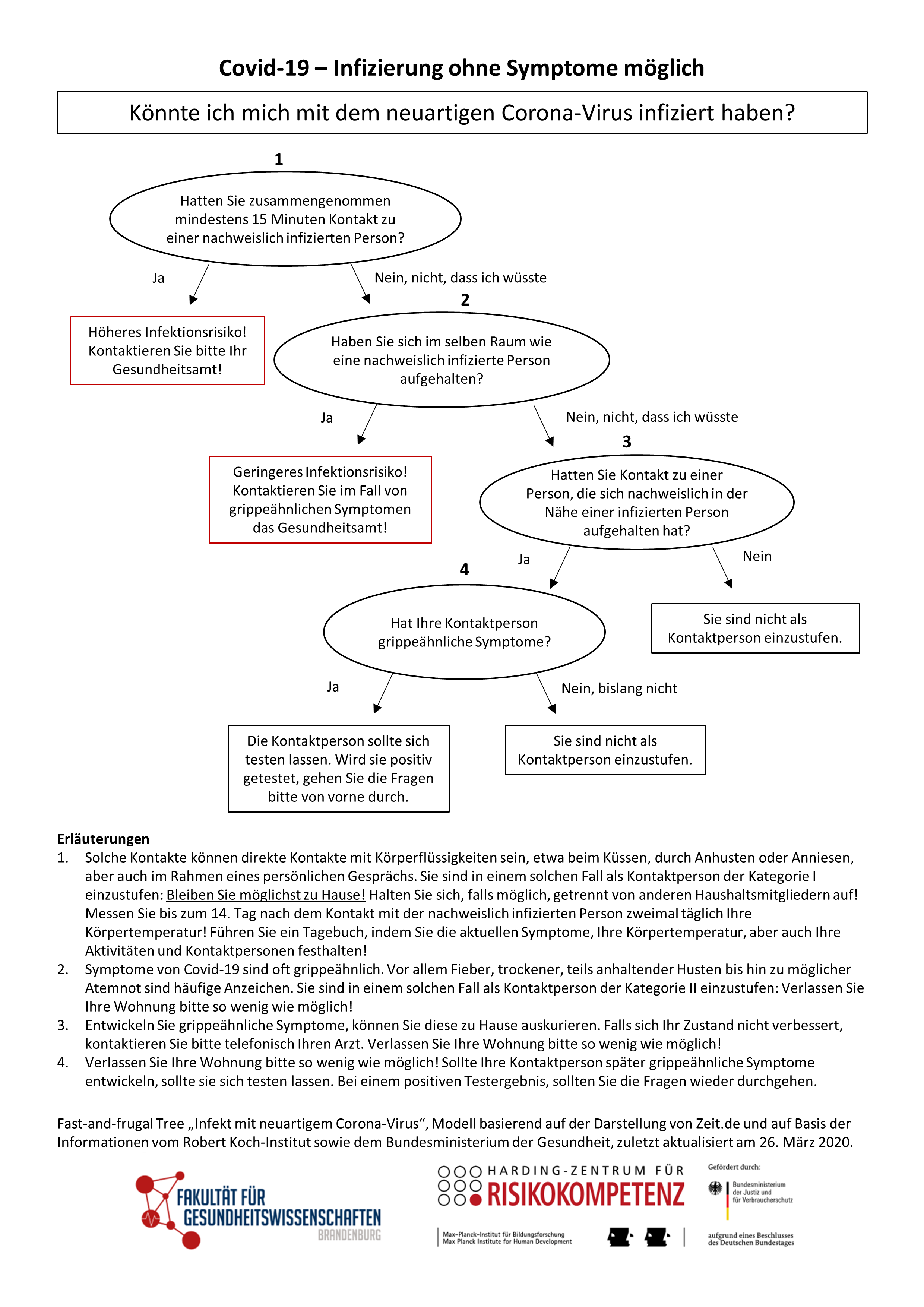

FFT-method model

Check risk of corona infection

If there is a lack of reliable data on the occurrence of specific events or knowledge on the consequences of decisions, there is a problem of uncertainty. Better decisions can hardly be achieved through the trained use of statistics or their transparent communication. Instead, the central question is how individual consumers can reduce uncertainty in their decision-making situation. Two scenarios are central here:

How can uncertainty be reduced (quickly, practically) for everyday problems in which consumers are left to their own devices?

How can uncertainty be reduced (quickly, practically) for everyday problems for which an expert provides advice to the consumer?

Why is it difficult to provide decision support for problems of uncertainty?

Decision problems of uncertainty are characterised by a lack of reliable data. This effectively rules out the direct selection of the best decision option. The support consists of identifying key strategies to reduce uncertainty. What do I need to ask to reduce the choice of potential information or options? What do I need to look for? What do I need to consider to sort out inappropriate options that do not meet the minimum requirements?

In contrast to consumers, experts in a particular subject area are able to identify objective shortfalls in the standard of a decision problem on the basis of fewer heuristic features. With the help of an analysis of specific consumer decision situations, possible expert heuristics are distilled into decision trees. These summarize the experts' gut feeling based on their experiences and provide consumers with a robust expertise that enables them, similar to the expert, to separate the wheat from the chaff.

This is not only important for issues where consumers are left to their own devices. Potential decision heuristics can also be combined in decision trees for consulting situations: Here it is a matter of asking the consultant the most important questions in order to be able to assess this situation robustly.

Fast-and-Frugal Trees (FFTs) are suitable decision trees that can be transparent, comprehensible to consumers and of high quality at the same time. These FFTs represent a sequence of features to be examined (Martignon et al., 2008). There is always only one branch (stop) or one arrives at the next test feature, but there are no further branches (see example below). This distinguishes the FFTs from the usual decision trees. Only the last feature in the chain has two branches.

It has been shown that FFTs enable fast and reliable decisions in various decision situations under uncertainty, e.g. in psychiatry, anaesthesiology, but also in the financial world (Aikman et al., 2014; Green & Mehr, 1997; Jenny et al., 2013). FFTs can be presented both digitally (e.g. app, website) and analogously to consumers (e.g. on posters or in brochures) in the form of a graphically illustrated, simple tree structure. This makes them an evidence-based instrument for decision support that is easy to implement. In the RisikoAtlas project it was developed and implemented for the first time for everyday consumer practice. The use of FFTs is also helpful because their application trains skills. The use of FFTs facilitates the internalisation of key characteristics for problems and stimulates critical thinking.

The order of features in an FFT is critical and must be determined in advance. There are both manual and more complex approaches using machine learning methods. Once statistically determined, this combination of features allows consumers to robustly classify decision options (e.g., whether an informed decision is possible) by independently examining those features.

- Aikman, D., Galesic, M., Gigerenzer, G., Kapadia, S., Katsikopoulos, K. V., Kothiyal, A., ... & Neumann, T. (2014). Taking uncertainty seriously: Simplicity versus complexity in financial regulation. Bank of England Financial Stability Paper, 28.

- Banerjee, S., Chua, A. Y., & Kim, J. J. (2017). Don't be deceived: Using linguistic analysis to learn how to discern online review authenticity. Journal of the Association for Information Science and Technology, 68(6), 1525–1538.

- Green, L., & Mehr, D. R. (1997). What alters physicians' decisions to admit to the coronary care unit?. Journal of Family Practice, 45(3), 219–226.

- Jablonskis, E., & Czienskowski, U. (2017). Decision trees online. http://www.adaptivetoolbox.net/Library/Trees/TreesHome#/

- Jenny, M. A., Pachur, T., Williams, S. L., Becker, E., & Margraf, J. (2013). Simple rules for detecting depression. Journal of Applied Research in Memory and Cognition, 2(3), 149–157.

- Luan, S., Schooler, L. J., & Gigerenzer, G. (2011). A signal-detection analysis of fast-and-frugal trees. Psychological Review, 118(2), 316.

- Martignon, L., Katsikopoulos, K. V., & Woike, J. K. (2008). Categorization with limited resources: A family of simple heuristics. Journal of Mathematical Psychology, 52(6), 352–361.

If you would like to adopt a consumer topic from our website, you can do so in the following three ways:

- You are using a digital copy. Either you directly save an illustration or download our PDF, or you integrate the illustration via Link (a href) or iframe.

- You take your analogue copy and print out our PDF. The resolution and vector-based graphic is suitable for posters and brochures.

- You recommend the app and refer to the Risikokompass from the PlayStore and AppStore.

If you would like to develop your own model, please consult the final report on the RiskAtlas project from July 2020 or contact us. Contact details can be found here.

When using the instruments, please mention the funding agency, which is the German Federal Ministry of Justice and Consumer Protection, and the Harding Centre for Risk Literacy as the responsible developers.

Logos can be downloaded here.

Where is the data coming from?

The model is based on a visualisation by Zeit.de and on information from the Robert Koch Institute and the German Federal Ministry of Health.

Last update: 26 March 2020.